Online Trading From Beginner to Expert

The Complete Guide to Online Trading: From First Trade to Market MasteryThe New Era of TradingThe online trading landscape is evolving rapidly, with the global trading platform market expected to reach $17.42 billion by 2033. Whether you're just starting or looking to level up your trading game, this guide will help you navigate the modern trading environment.

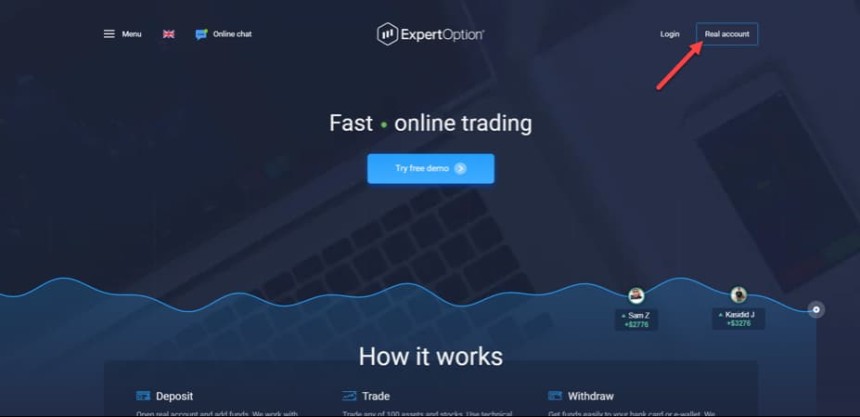

Getting StartedChoosing Your PlatformThe right platform can make or break your trading experience. As of 2025, the top-rated platforms include:

- Charles Schwab: Best overall trading experience

- Fidelity Investments: Excellent research tools

- Interactive Brokers: Advanced trading capabilities

- Webull: Perfect for beginners

- E*TRADE: Strong mobile trading options

According to recent analysis, these platforms stand out for their combination of user-friendly interfaces, educational resources, and competitive pricing.

Essential RequirementsTo start trading, you'll need:

- A valid government ID

- Social Security number

- Bank account for funding

- Stable internet connection

- Basic understanding of market mechanics

Before you begin, know that pattern day trading rules require a minimum of $25,000 in your account if you plan to make four or more day trades within five business days. This rule protects investors and maintains market stability.

Core Trading Strategies1. Trend FollowingThis remains one of the most reliable approaches for beginners. Watch for established market trends and trade in their direction. Look for:

- Clear price momentum

- Supporting volume

- Confirmation from technical indicators

Perfect for beginners with limited time, swing trading involves holding positions for several days to weeks. Focus on:

- Major price movements

- Strong fundamental catalysts

- Clear entry and exit points

For those with patience and longer time horizons:

- Based on fundamental analysis

- Lower time commitment

- Reduced trading costs

- Never risk more than 1-2% of your account on a single trade

- Always use stop-loss orders

- Avoid trading with borrowed money

- Keep detailed trading records

- Start small and scale gradually

Modern platforms offer sophisticated analysis tools:

- Real-time market data

- Advanced charting capabilities

- News feeds and economic calendars

- Risk assessment tools

- Portfolio analysis features

Success in trading is 80% psychological:

- Develop a trading plan and stick to it

- Control your emotions

- Accept losses as learning opportunities

- Don't chase the market

- Take regular breaks

Master these essential tools:

- Moving averages

- Relative Strength Index (RSI)

- MACD (Moving Average Convergence Divergence)

- Support and resistance levels

- Volume analysis

Learn to evaluate:

- Company financial statements

- Industry trends

- Economic indicators

- Market sentiment

- Global events impact

The trading world evolves constantly. Stay updated through:

- Financial news websites

- Trading webinars

- Professional courses

- Market analysis tools

- Trading communities

- Overtrading

- Not having a clear strategy

- Ignoring risk management

- Trading without proper research

- Letting emotions drive decisions

- Start with small, achievable targets

- Focus on consistency over big wins

- Track your progress regularly

- Adjust strategies based on results

- Build your knowledge systematically

- Set specific trading hours

- Plan your research time

- Schedule regular strategy reviews

- Make time for continuous learning

- Balance trading with other activities

Trading isn't a get-rich-quick scheme – it's a skill that requires dedication, patience, and continuous learning. Start small, focus on education, and remember that consistency beats intensity every time. Your success will come from disciplined execution of well-researched strategies rather than lucky breaks.